Renewables Benchmark

CHARTING THE FUTURE

Introducing the Renewables Benchmark

In 2024 we expanded our Utilities Benchmark and launched a Renewables Analysis covering Directors, CEOs and Executives. We assembled data from 18 renewable companies. Next year we hope to expand that number to provide vital information to enable renewable companies to set their board and executive remuneration strategy. We need your contribution.

Renewables now occupy centre stage in the energy space. Governments and industry are investing heavily, with major projects underway across Australasia.

Companies who get their remuneration strategy right will be in a better position to attract and retain the best senior leaders.

Renewables Benchmark 2024 Now Available

The market for senior leaders in the Renewables Sector is very strong and competitive positioning is critical to attract and retain the best senior leaders. Contact Geoff Nunn if you have an interest in subscribing to the 2024 Edition of our Renewables Benchmark: gtnunn@gna.net.au and see further information here: Renewables Brochure 2024

-

Renewable energy companies need to leverage their competitive advantage to attract and retain capable directors, CEOs and executives. The industry is an attractor from ethical and environmental perspectives—people want to be associated with the future, and make a contribution to a cleaner and greener planet.

-

As the sector becomes increasingly competitive, how you structure remuneration is key. It is an essential driver of success.

The Renewables Benchmark provides an overview of board, CEO and executive remuneration in the rapidly developing Renewables Energy Sector across Australia and New Zealand.

-

The Renewables Benchmark will enable your organisation to consider the key factors and market influences in determining a remuneration strategy for directors, CEOs and executives that’s right for your company’s stage of development.

Attract & Retain the Best People

In the exploding renewable sector, it’s vital to get your remuneration strategy right. The Renewable Energy Benchmark is a unique offering to help you do this. Some renewable companies have been paying a premium to attract the right directors, CEOs and senior executives. The market is volatile and demand is strong.

Each year we benchmark remuneration for senior roles across the Utilities Sector. We launched our first Renewables Benchmark 2023 and the 2024 update is now available.

Renewable Energy Remuneration Strategy

Board and executive remuneration strategy in the renewables sector needs to reflect the company’s stage of development. To help you formulate your strategy we’ve identified three distinct stages:

Stage 1: Developing. This stage covers all the steps from project initiation and approvals through to commissioning.

Stage 2: Operating. The company has commenced generation with one or more sites fully operational, and has been delivering electricity into the grid for one to three years.

Stage 3: Maturing. The company has a large operational site or multiple sites and has been active in the grid for three plus years.

Remuneration Strategy Differs For Each Stage

Getting the strategy right balances affordability; market competitiveness; the attraction, development and retention of capable directors and executives. Each company’s circumstances are unique. For some general guidelines on remuneration strategy in renewable companies see our Governance Update here:

Renewables Benchmark 2024

Some Key Findings

-

CEO and Executive FAR Continues Strong Growth

The market for executive remuneration continued to strengthened in 2023. Demand for capable executives in renewable companies rose significantly as a range of projects progressed. We’ve seen increases of up to 10.0% in some cases as companies focus on retention of capable executives.

-

Board Fees are on Hold For Most Companies

Board fees remained relatively flat during 2023. Many renewable boards are well paid compared to other sectors. Some directors are salaried executives of owner companies and do not receive board fees directly. Thus, there is little market pressure for fee increases in privately owned companies.

-

STI Awards Have Recovered and Strengthened

STI payments increased in 2023 and returned to pre-pandemic levels. Financial results improved for some renewable companies. Safety performance remained sound as did the results of customer surveys. Some made STI awards up to 90.0% of the maximum.

-

Turnover Continues Amongst CEOs and Executives

With the level of project work going on across Australia and New Zealand demand for capable CEOs and executives remains strong. The level of attrition is low in the renewables sector compared to general utilities. Many CEOs and executives are invested in the renewables company purpose.

-

Remuneration Governance is a Priority

Stakeholder scrutiny of all aspects of board and executive remuneration outcomes continues to be intense. Qantas is a case in point, and this will continue in 2024. Boards and Remuneration Committees have been rigorous in the application of executive remuneration governance principles.

-

Finding the Right Strategy Direction

Remuneration strategy in a renewable companies needs to reflect the stage of development. Focus is on long term reward for companies in the start-up phase moving to a balanced approach between short- and long-term reward as the company matures.

-

Benchmark by Revenue

Revenue is an important measure of company size and both board and executive remuneration are related to this. Our benchmark sample is made up of a representative mix of renewable companies ranging from relatively small start-ups through to national and multinational players.

-

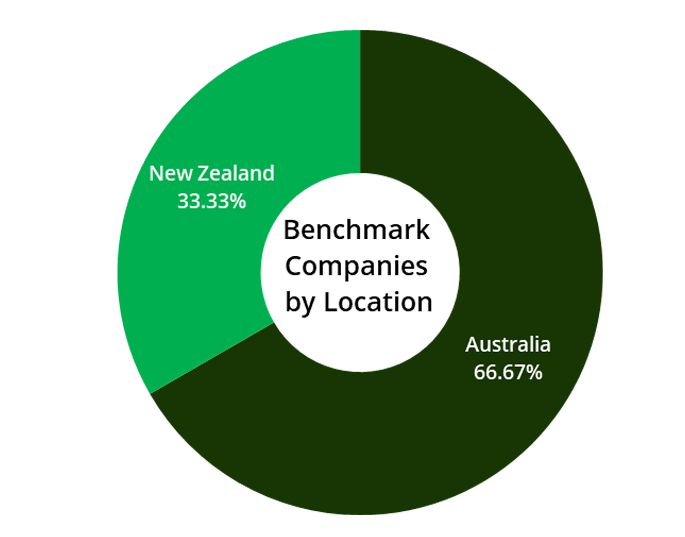

Benchmark by Country

Of the 18 companies in our benchmark database 12 are based in Australia and 6 in New Zealand. Remuneration levels are relatively consistent between countries on a dollar-for-dollar basis. There is some level of executive movement across the Tasman.

-

Benchmark by Ownership

In this benchmark sample 7 companies are in government ownership and 11 in private ownership or listed on the ASX or NZSX. Government owned renewable companies (with the exception of Snowy Hydro) are generally less inclined toward variable STI and LTI reward.

Market Movements and Forecast 2024

Trying to predict CPI and market movements for FAR is a challenge in 2024. Our most talented economists can’t agree and forecasts for the CPI keep changing. Conflicts and potential across the world make forecasting difficult. The flow-on to global markets is unsettling. Notwithstanding this we believe FAR reviews for CEOs and the executive team will be in the order of 3.50% to 4.00% across the Renewables Sector.

Board and Remuneration Committee Checklist

The board and remuneration committee of a renewable company confront a number of key questions when formulating executive remuneration strategy:

Will our market positioning for Fixed Annual Remuneration enable us to attract the best CEO and executive team who can deliver on our project development pipeline?

Is the balance of short and long term incentives appropriate to reward performance without compromising affordability and cashflow?

Have we got the right tracking mechanisms in place to enable effective performance evaluation over the short, medium and longer term?

Is our risk management framework sufficiently robust to ensure that we are not rewarding inappropriately achieved outcomes?

Is our board and executive remuneration strategy documented effectively and does it meet governance requirements of our stakeholders and regulators?

Have we communicated effectively with our CEO and executives about the progressive development of our remuneration strategy?

And let’s not forget the Chair and Non-Executive Directors. Board remuneration needs to be pitched to reflect the company’s stage of development. Capable directors will be keen to join the board of a renewable company to share their expertise and be part of the future.

To discuss how we can assist your company email Geoff Nunn: gtnunn@gna.net.au

Renewables Benchmark - Positions Covered:

Board Positions

Board Chair

Deputy Chair

Non-Executive Director

Chair, Audit & Risk Committee

Member, Audit & Risk Committee

Chair, Other Committee

Member, Other Committee

Executive Positions

Managing Director/Chief Executive Officer

Chief Operating Officer/GM Operations

Chief Customer Officer/GM Retail

Chief Financial Officer/GM Finance

GM People & Culture

Chief Information Officer

General Counsel/Company Secretary

GM Strategy/Business Dev./Commercial

GM Assets/Engineering/Major Projects

The Governance Landscape

Renewable energy companies have an advantage when it comes to the attraction of capable directors, CEOs and executives, because the Sector is attractive from an ethical and environmental perspective. Many want to be associated with the future and make a contribution to a cleaner and greener planet.

Boards and remuneration committees can leverage this advantage, when it’s backed up with tangible and market-competitive remuneration practices. We recommend renewable companies follow these remuneration governance principles:

Remuneration levels need to reflect the company’s stage of development.

Remuneration should be sufficient to attract and retain capable directors and executives without being excessive and fuelling the market.

All remuneration decisions should be subject to a “one level removed” overview to ensure bias is minimised.

Remuneration packages should be structured in a way to minimise flight risk.

The overall remuneration strategy needs to be formulated in accordance with

best practice governance

industry standards

and the regulatory environment.

See also: Executive Remuneration Strategy, Tailored Remuneration Solutions and Utilities Benchmark